-

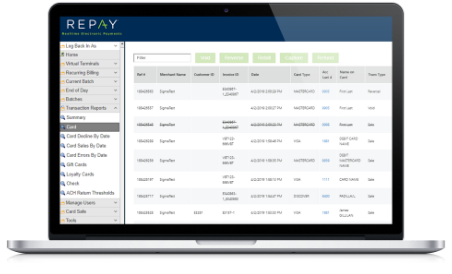

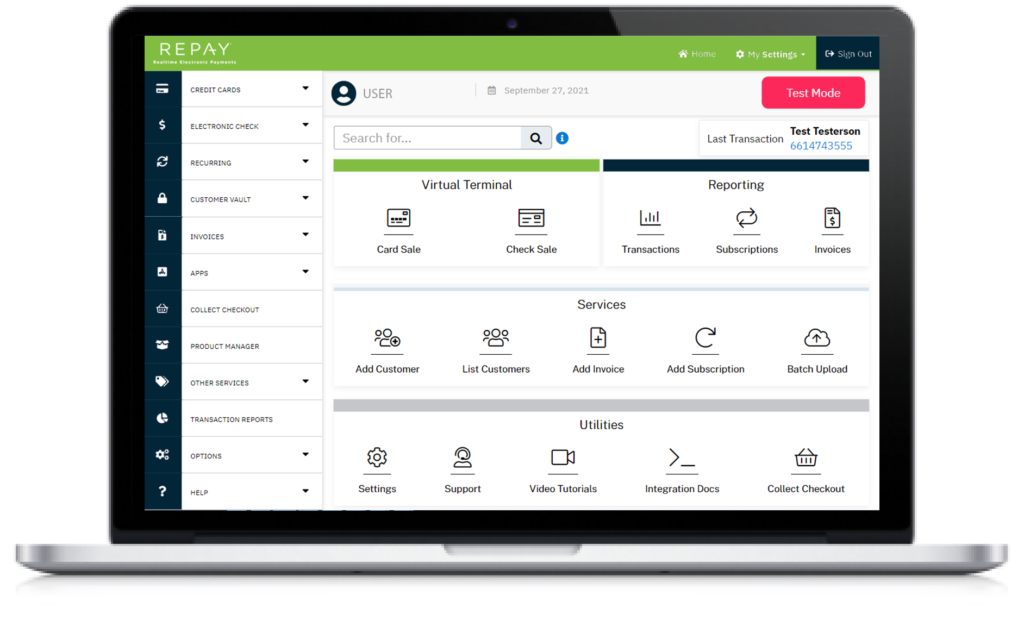

REPAY Gateway

-

REPAY Channels

Having trouble? Chat below or contact us.

-

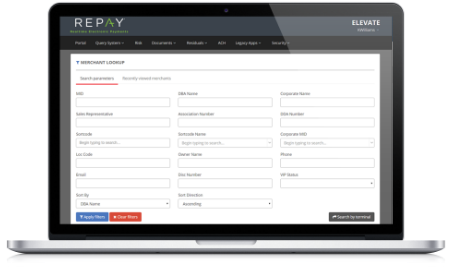

REPAY Elevate

-

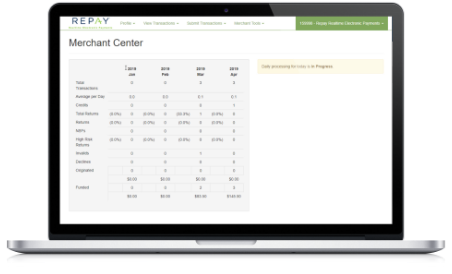

REPAY Sigma

-

REPAY Paymaxx

-

REPAY Legacy Card Gateway

-

REPAY Legacy ACH Gateway

-

REPAY Legacy ACH Backend

-

REPAY LIFT™ Platform

-

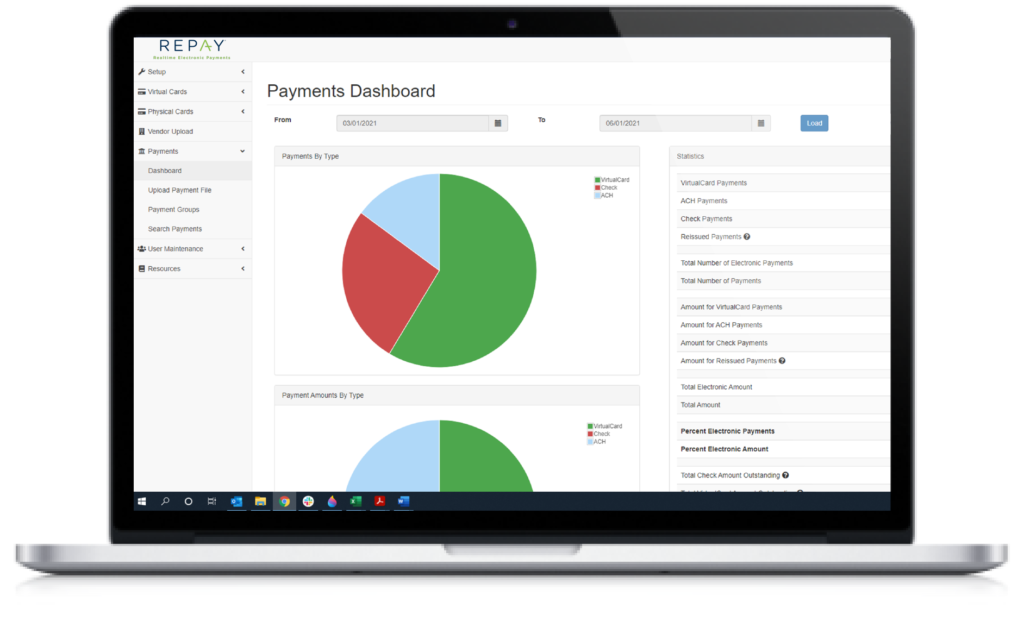

REPAY Vendor Payments (formerly cPayPlus)

-

REPAY B2B Gateway (formerly APSPays)

-

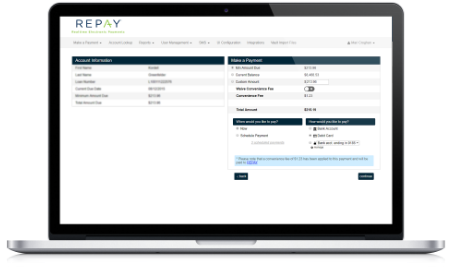

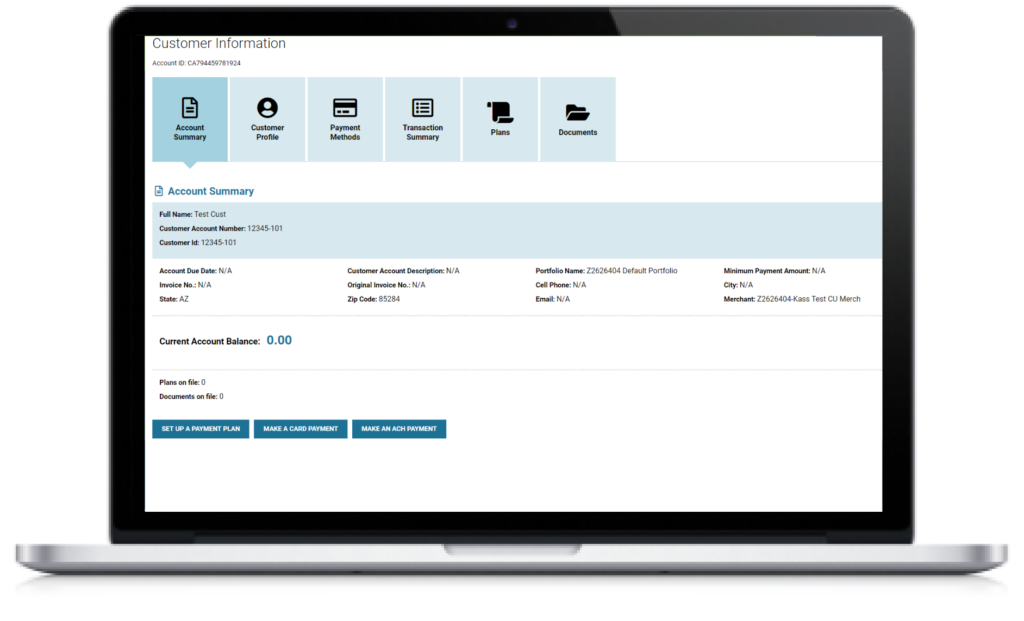

REPAY Payrazr® (formerly BillingTree)

-

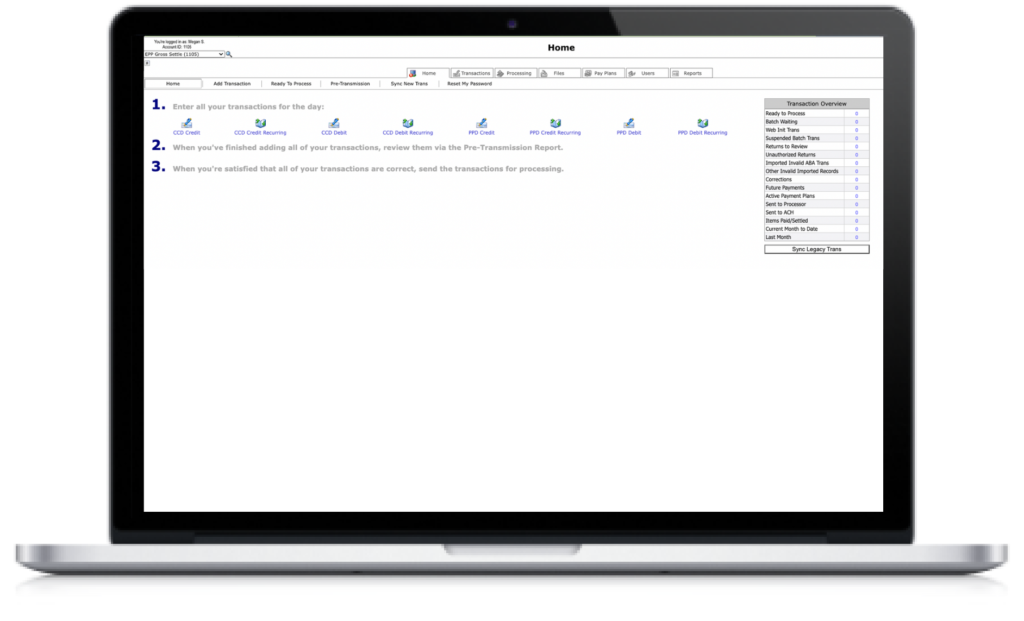

REPAY ACHNow (formerly BillingTree)

-

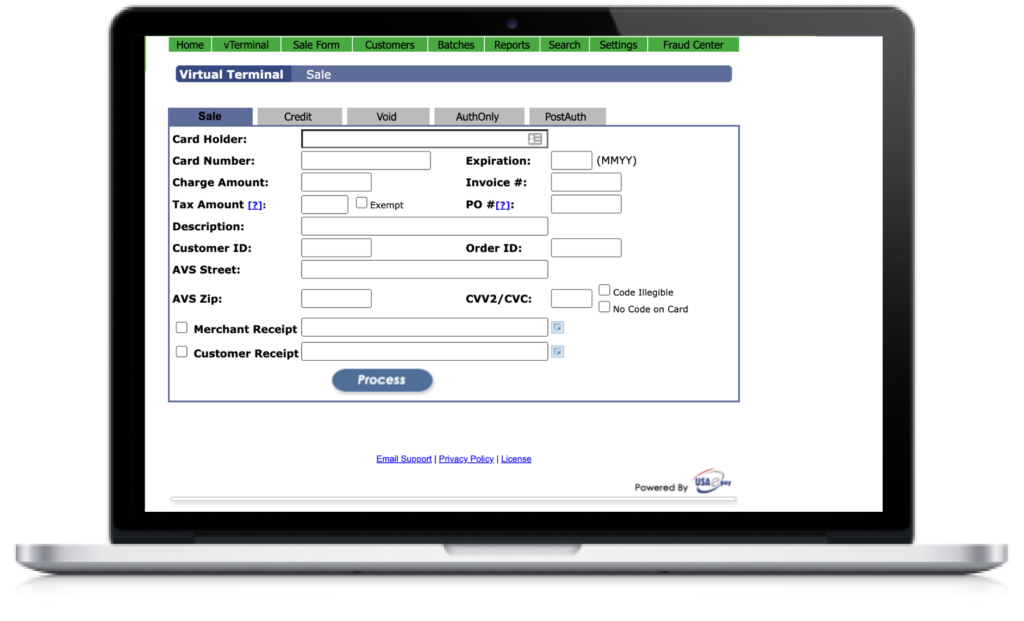

REPAY Legacy Card Gateway (formerly BillingTree)

Partners

-

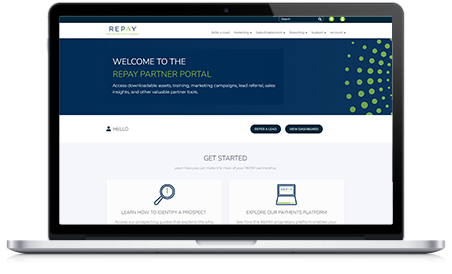

REPAY Partner Portal

-

Authorize.net

-

EFT Network

-

MeS Account Reporting